Demand for cellulose-based solutions appears promising due to increased environmental awareness, the impending ban on single-use plastic products, especially in Europe, and restrictions and labeling on products containing plastic fibers.

The market, and in particular retailers, are looking for sustainable and renewable alternatives to oil-based synthetic fibers, which still account for more than 60% of textile production. However, the recycling of textile waste and used clothing remains a fundamental issue.

All of this has led to rapid technological developments that have made possible material properties previously thought to be unattainable with cellulosic fibers. At the same time, a number of exciting developments, particularly in textile recycling and alternative raw materials, are beginning to emerge.

Cellulose fibers have grown at a compound annual growth rate of 5-10% over the past 10 years and are expected to see similar growth over the next decade. With such high growth rates compared to other man-made fibers, the current challenge will be to balance continued capacity expansion with the growing demand for natural fibers, taking into account the microplastics issue and the potential ban on certain plastic fibers.

1. Market growth

Cellulose fibers have grown at a compound annual growth rate of 5-10% over the past 10 years and are expected to see similar growth over the next decade. With such high growth rates compared to other chemical fibers, the current challenge will be to balance continued capacity expansion with the growing demand for natural fibers, while taking into account microplastic issues and the possible prohibition of plastic fibers for certain applications.

Andreas Engelhardt of The Fibre Year notes that while most textile markets are currently in a downturn and global economic activity is not expected to normalize in the near term, cellulosic fibers appear to have a good future as consumer awareness and demand for sustainable clothing continues to grow, which should spur growth in consumption of viscose and PLA fibers. For example, global viscose staple fiber (VSF) production capacity is expected to increase to 10 million tons by 2025. However, cellulose fibers are unlikely to account for more than 10% of the total fiber market in the foreseeable future, Bernhard says of Sappi's dissolving pulp Riegler. he says fossil-based plastics in the form of synthetic fibers will continue for some time. Outlining the steps taken by Sateri, the world's largest viscose fiber producer with five mills and a combined annual production of 1.5 million tons, to promote circularity through textile recycling, clean manufacturing and water management, Sharon Chong said the viscose market will remain healthy because of the growing Chinese middle class and increased awareness of sustainable natural materials.

2. Marine litter

Sanitary and hygiene products rank in the top 10 of marine litter found on European beaches (9.5% of the total), behind beverage bottles, cigarette butts, cotton swabs and crisp packets/sweet wrappers. According to the European Commission, wet wipes account for 8.1 percent of this waste and feminine hygiene products account for 1.4 percent.

Rahul Bansal, assistant vice president and head of global business development for Birla Cellulose Nonwovens, noted that synthetic fibers account for 54 percent of the staple fibers used in nonwovens worldwide, with viscose/Lyser fibers accounting for 8 percent and wood pulp for 16 percent. He presented several sustainable fiber innovations developed with Birla Purocel for absorbent hygiene products, surface cleaning wipes and flushable wipes.

3. Innovation in line with sustainability

Lenzing Web Technology is an innovative cellulose spinning technology for next-generation biodegradable nonwovens that produces fabrics made from 100% continuous Lyser filaments by combining the spunbond and Lyser processes, explains Katharina Gregorich of Lenzing.

The technology provides a unique self-bonding mechanism in which the filament is bonded to the fabric during placement, offering a wide range of filament diameters (currently 5-40 µm) and a basis weight range of 15-80 g/m².

Gregorich says this combination enables a wider range of surface textures and dimensional stability than other current nonwoven technologies. In addition, the fabric is absorbent and free of finishing agents and chemical binders, allowing for biodegradable and compostable applications in durable and disposable nonwovens.

The Austrian-based cellulose fiber producer has invested €26 million in a pilot line for Lenzing Web Technology, which won the Austrian National Innovation Award in 2020.

4. Femcare trade-offs

The average woman will use 15,000 feminine hygiene products in her lifetime, and 96% of those women will buy disposable products such as traditional sanitary napkins that contain up to 90% plastic. Studies have shown that the plastic content in feminine care products takes up to 500 years to break down, remaining in the environment as microplastics and contributing to land and ocean pollution.

But while sustainability is now an important advantage for many products, few consumers of feminine hygiene products are willing to give up performance over biodegradability.

Dominik Mayer, project manager for fiber and application development at Kelheim Fibres in Germany, said the company's cellulose-based fibers can contribute to improving feminine care products by combining sustainability and technological innovation to promote the use of biodegradable fibers. This can be achieved through fiber functionalization, modification of fiber cross-section and fiber size adjustment.

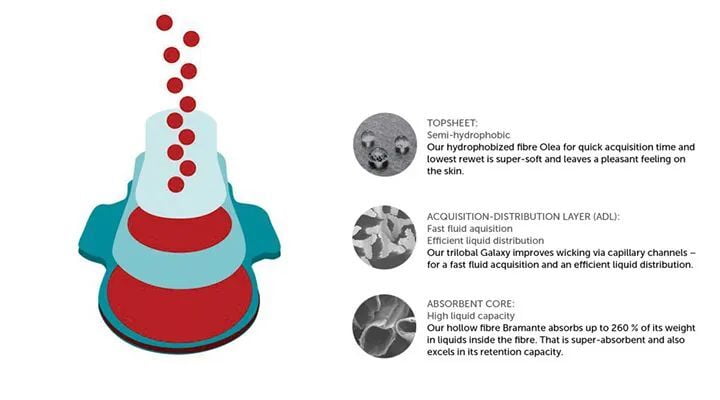

Kelheim Fibers develops plant-based fiber solutions for absorbent hygiene products, including single-ply specialty fibers with different functions: hydrophobic fibers for the top layer (Olea), trilobal fibers for the collection/distribution layer (Galaxy) and hollow fibers for the absorbent core (Bramante).

These biodegradable and sustainably manufactured fibers can replace synthetic fibers without any loss of performance, says Ilka Kaczmarek, innovation manager at Kelheim Fibres. The material could potentially be used to produce reusable menstrual underwear, pads and diapers.

The first commercial product using Kelheim's fiber solution - a top sheet - is now being developed with German nonwoven manufacturer Pelz Group and is scheduled to be launched later this year.

5. Ionic liquid technology

Paul O'Connor of Cellicon, based in the Netherlands, has proposed a new method for separating valuable components of biomass (polymeric cellulose and polycyclic aromatic lignin) without destroying or damaging these components and without the use of enzymes or costly organic ionic liquid technology.

The method exploits the ionic liquid-like nature of ZnCl solvents and can be used to convert cellulosic materials into nanocellulose and lignin, which are suitable candidates and/or precursors for the production of high-performance fibers such as ultra-nanocellulose fibers and carbon fibers.

6. New technologies and alternative raw materials

Antje Ota of the Deutsche Institute für Textil- und Faserforschung (DITF Denkendorf) demonstrated biopolymer fibers, such as cellulose and chitin, derived by a HighPerCell spinning process using ionic liquids as solvents. The institute is also exploring new cellulose-based carbon fibers based on ionic liquid-derived cellulose fibers to replace crude oil-based carbon fibers.

Heikki Hassi from SciTech-Service, Finland, discusses some of the key mechanisms and factors associated with the highly organized structure of plant cellulose that need to be controlled in order to develop and manipulate processes for manufacturing man-made cellulose fibers.

Stina Grönqvist of VTT Technical Research Centre of Finland provides insight into the use of different types of hydrolytic and oxidative enzymes to modify dissolving and paper grade pulp.

The viscose industry is transitioning to upstream consolidation, with all major players investing in modern dissolving wood pulp (DWP) and VSF production facilities to better control raw material costs and product quality, as well as sustainability assurance in the supply chain, says João Cordeiro of Finland's AFRY management consulting firm.

He noted that both DWP and cellulose fiber lines continue to expand. For example, Bracell's 1,250 kt/a DWP plant is expected to open in Brazil; Lenzing is building a 100 kt/a lyocell plant in Thailand; and the largest VSF plant (currently 125 kt/a) is expected to reach 200-300 kt/a in the future.

In terms of raw material sourcing, there are many doubts as to whether new fibers will become mainstream, especially in the textile recycling value chain, which faces many obstacles and bottlenecks. Meanwhile, the Metsä Group in Finland has developed a new energy-saving process based on a new family of solvents to produce high-quality cellulose fibers for the textile industry.

Niklas von Weymarn, CEO of subsidiary Metsä Spring, says using ionic liquids as solvents allows cellulose fibers to be produced from paper-grade pulp, avoiding the use of energy-intensive dissolving pulp, which has ecological and economic advantages.

In 2018, Finnbottom Spring formed a 50:50 joint venture with Itochu Corporation of Japan to build a greenfield demonstration plant in Äänekoski, Finland. With a budget of €40 million, the goal of the facility is to demonstrate new technology with a production capacity of 1 ton/day; a full-scale production plant is possible.

Hemp-based Lyser fibers, performance-enhanced bast fibers, and the use of bio-based ionic liquids to recover cellulose from a variety of alternative feedstocks, including textile recycling and biomass waste streams, were also presented during the conference.

7. Pulp reality

Maintaining and restoring forests has been identified as a key part of the climate solution. The scientific community is calling for the protection and/or restoration of 30-50% of the world's forests by 2030, and no new or existing pulp mills should be sourcing from the world's old and endangered forests, argues Nicole Rycroft, founder and executive director of the company Canopy. The Canada-based NGO developed the Next Generation Action Plan, which outlines the technical and economic feasibility of shifting production of man-made cellulosic fiber textiles to forest fiber alternatives.

As many brands begin to shift, Rycroft says about 200,000 tons of next-generation viscose fibers will enter the market within a year, with rapid growth expected after 2023.