Bio-based plastics refer to new materials whose raw materials are wholly or partly derived from biomass (corn, sugar cane or cellulose, etc.),The ones represented by PLA, PHA and polyamino acids are all biodegradable, while those represented by polyol polyurethane and bio-based PE/PET are non-biodegradable. According to data released by European Bioplastics (European Bioplastics Association), in 2020, the global bio-based plastics production capacity will reach 2.111 million tons. Mainly distributed in Asia; at the same time, the proportion of biodegradable production capacity is continuously increasing, and the application fields are diversified.

1. 2020 production capacity will exceed 2 million tons

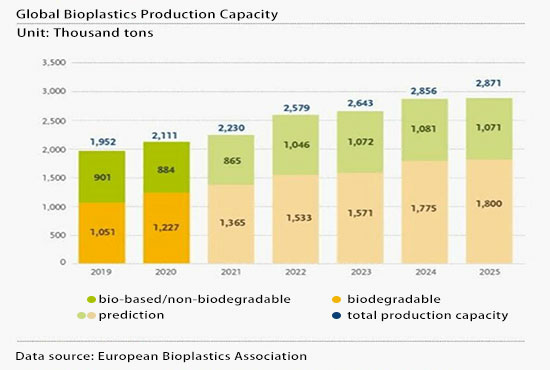

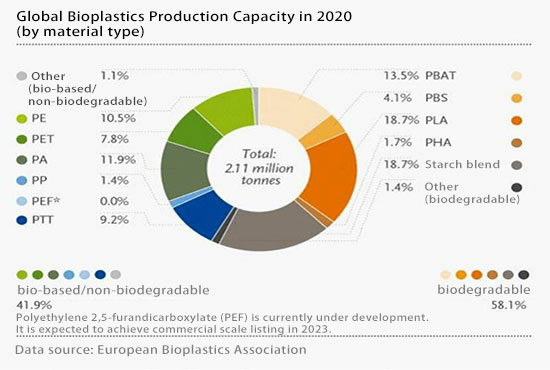

According to the latest data released by European Bioplastics (European Bioplastics Association), global bio-based plastics account for approximately 1% of plastics produced each year. In 2020, the global bio-based plastics production capacity will reach 2.111 million tons, of which the production capacity of biodegradable plastics will be 1.227 million tons, and the production capacity of non-biodegradable plastics will be 884,000 tons.

At the same time, with the development of environmental protection industries in various countries around the world, the proportion of biodegradable plastics in the production capacity of bio-based plastics has been increasing, and the proportion of non-biodegradable plastics has been declining.

New biopolymers such as polylactic acid (PLA), bio-based polypropylene (PP) and polyhydroxyalkanoates (PHA) continue to show high growth rates. Among them, after the commercialization of bio-based PP in 2019, due to its wide application in many fields, the production capacity will increase by more than three times by 2025; the production capacity of PHA will increase nearly ten times in the next five years.

In total, non-biodegradable bio-based plastics account for more than 40% of the global bioplastics production capacity (nearly 890,000 tons). These also include "drop-in" solutions such as bio-based PE, bio-based polyethylene terephthalate (PET), and bio-based polyamide (PA).

As the output of degradable plastics is expected to reach a higher level of growth, by 2025, the share of the above-mentioned non-biodegradable bio-based plastics will drop slightly to slightly more than 37% (about 1 million tons).

The proportion of bio-based PET production capacity will also continue to decline. The current market's research and development focus has shifted to polyethylene 2,5-furandicarboxylate (PEF), and this new polymer is expected to be launched on the market in 2023. PEF is 100% bio-based, comparable to PET, and has excellent barrier properties and thermal properties, making it an ideal material for packaging beverages, food and non-food products.

2. The largest application scale in the packaging field

From the perspective of downstream applications of production capacity, in 2020, the downstream application fields of global bio-based plastics will be diversified. Among them, the packaging field is the largest application field of bio-based plastics in the world. In 2020, it will account for 47% of the total bio-plastics market. (Approximately 990,000 tons). Respectively, 555,000 tons of production capacity are used for the production of flexible packaging, and 443,000 tons of production capacity are used for hard packaging. Bioplastics are used in more and more markets, from packaging to food and beverage products, from consumer electronics to automobiles, from agriculture/gardening and toys to textiles and several other market segments. Packaging is still the largest application field of bioplastics. However, the application scope of bioplastics is still developing in a more diversified direction. As the production capacity of functional polymers continues to increase, market segments including the automotive and transportation industries, construction, electrical and electronic industries are still expanding.

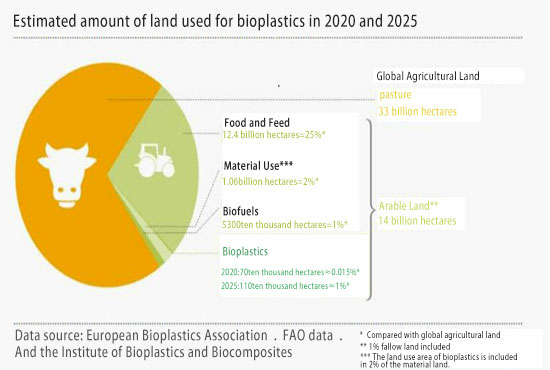

3.The share of land use of bioplastics increased slightly

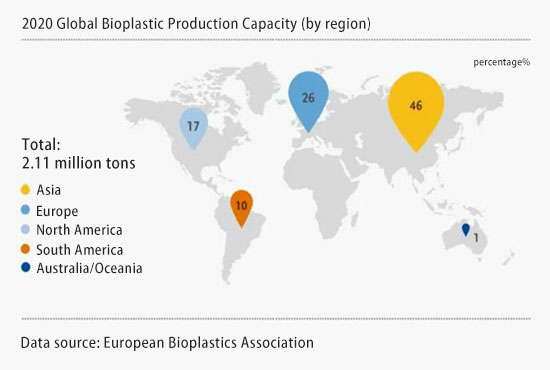

Europe has once again consolidated its position as the main hub of the entire bioplastics industry, ranking highest in the field of research and development, and is the industry's largest market in the world. As of now, 1/4 of the global bioplastics production capacity is located in Europe. However, from the perspective of actual production of bioplastics and regional capacity growth, Asia continues to lead. In 2020, Asia produced 46% of the world's bioplastics, and the region will remain a major production center in the next five years. The proportion of North America's production will slightly increase from 17% in 2020 to 18% in 2025.

The European Bioplastics Association also pointed out that there is no competition between renewable raw materials used in food, feed planting and bioplastic production. In 2020, about 700,000 hectares of land will be used to grow renewable raw materials to produce bioplastics, accounting for 0.015% of the total global agricultural land area of 4.8 billion hectares. And 94% of agricultural land is used for pasture, feed and grain cultivation. Although the market is expected to grow further in the next five years, the share of land use of bioplastics will only slightly increase to 0.02%.